New research published today by LINK, the UK’s Cash Access and ATM network, shows more people would prefer a gift card or voucher if they were to receive a financial gift this Christmas. However, despite the growing ubiquity and convenience of digital payments, cash was the most popular financial gift for all age groups under 45.

When asked what they would prefer to receive, gift cards and vouchers (42%) was the most popular followed by cash (39%). One quarter (25%) prefer to receive a bank transfer, while more than one in ten (11%) would eagerly await a cheque. With higher interest rates compared to last year, 14% said they’d like money to go straight into a savings account with a further 8% opting for Premium Bonds.

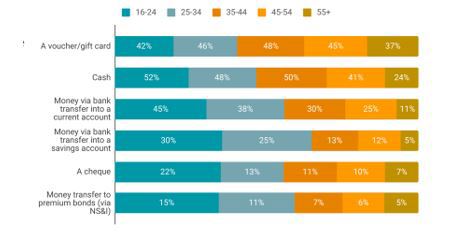

Cash was the most popular gift to receive for age groups under 45. Over half (52%) of 16-24 years olds surveyed, so-called Generation Z, said they’d prefer to receive cash as a Christmas present compared to a bank transfer (45%) or voucher (42%). Interestingly, this age cohort gave a strong response to receiving a cheque too, with 22% responding positively. The UK average is 11%.

Alongside receiving gifts, LINK also asked about giving presents with nearly 8-in-10 people (78%) considering giving a financial gift this Christmas. When asked what type of financial gift people would prefer to give, the most popular present would be a gift card or voucher (42%) followed by cash (36%). Both come in ahead of a bank transfer at 16%.

The regions where people are most likely to give a financial gift are the North West (42%), East Midlands (41%) and South West (41%). London (28%) and the South West (32%) where the regions were people were least likely to give a financial gift. Of those giving a financial gift, 26% they’d be likely to give between £20-£50 with a further 17% likely to give between £50-£100.

On average, UK customers typically withdraw around £1.6bn a week. This year, LINK expects the busiest day of the year to be Friday 22 December with an estimated £500m likely to be withdrawn.

Graham Mott, Director of Strategy, LINK, said: "Christmas is always the busiest period for cash machines with lots of people withdrawing money to pay for shopping, a round or two at the pub or as a gift. The busiest day for cash machines on the LINK network was actually back in 2016 on 23 December when £730m was withdrawn in one day. While more people now pay for things using their phones or cards, we’re still expecting somewhere between £450m and £500m to be paid out on Friday the 22 this year.

“Looking at the data, we can definitely see the preferences between generations with younger people very much open to cash gifts, which perhaps should not come as a surprise. However, it does go to show you the popularity of receiving a few notes rather than giving someone a voucher or a present that may not want!"