News

Five years on from the Access to Cash Review, the UK is still not ready to go cashless

- Almost half of people think UK heading towards a cashless society

- Greater push is needed to help people use digital services

New research published today by LINK, the UK’s cash access and ATM network, shows that almost half of people think the UK is heading towards a cashless society. Five years on from the landmark Access to Cash Review, despite big changes in how we use cash, a similar number of people would still find a cashless society problematic.

LINK asked a representative sample of 2,214 adults the same questions as were asked five years ago, and the results show both the big changes in how we use cash, and the major barriers to us going cashless.

More people don’t carry cash

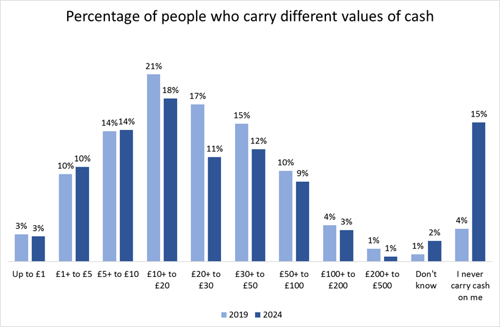

The number of people who say they don’t carry cash has trebled since 2019. This isn’t surprising when the popularity of using cash for day-to-day shopping, lunchtime sandwiches, alcohol and the weekly shop have all dropped significantly. More people now say they carry cash in case they can’t pay for something by card, and the most popular amount is between £10 and £20.

Still a huge reliance on cash

Despite these massive changes, 71% of people still have some level of everyday reliance on cash and have used cash in the past two weeks.

LINK data shows that UK consumers are still withdrawing £209 million a day from cash machines, however, this is £100m (33%) less than 2019.

More people expect society to be cashless in their lifetime.

As more customers are banking and paying for things digitally, especially since the pandemic, for some people the idea of a cashless society is becoming more real. In 2019, 41% of people thought that they would see a cashless society in their lifetime. That figure is now 48%.

Despite wider digital adoption, the research shows a growing divide among society to whether a cashless society would be problematic. Almost half of the population (48%) say it would be problematic (up 1% from 2019) compared to 39% of people who wouldn’t find it problematic (up six per cent from 2019).

John Howells, CEO, LINK: “Although the UK is on the way to becoming a low cash country, we now have legislation that will help LINK maintain a national network of free ATMs and banking hubs and this will ensure that anyone needing to access cash can do so. But it’s no use having cash if the best goods and services are only available online and this is becoming a real problem for millions of cash-reliant consumers. The focus now needs to be on access to digital, so we don’t end up with 5 million consumers not being able to benefit from the best products and services on offer.”

Natalie Ceeney, Chair, Access to Cash Review: “Despite a massive growth in digital payments over the past five years, there are still millions of people who depend on cash, and half of the UK population concerned about the prospect of a cashless society. People need cash for a wide range of reasons, and the barriers to using digital payments are very real. There are still over three million adults in the UK without a smartphone; with fraud accounting for 40% of all crime there are many who are frightened of being scammed; over a million people who don’t have a bank account, and almost a million people in the UK live with dementia. Even many digitally savvy consumers find it easier to budget with cash. We are certainly not ready to become a cashless society.

“We’ve achieved a huge amount since the Access to Cash Review five years ago, including legislation to protect access to cash and joint work between the nine biggest UK retail banks to roll out Banking Hubs. But one recommendation that I made has not been implemented, which is the need to include everyone in a digital society. There are ways that we could increase people’s confidence, capability and access to digital payments safely – which would be good for society as well as individuals. Just as industry and government came together to protect cash, we need to do the same to make digital services a safe and effective choice for more people.”